County disputes ordinances on levy tax

“That’s another thing that was kind of frustrating, they could have waited a little bit to start handing them out but they decided to go full speed ahead.” – Jon Snyder, City council member (District #2)

March 5, 2015

The Spokane City Council and other city officials are working toward keeping the promise made in regards to the 2014 street levy.

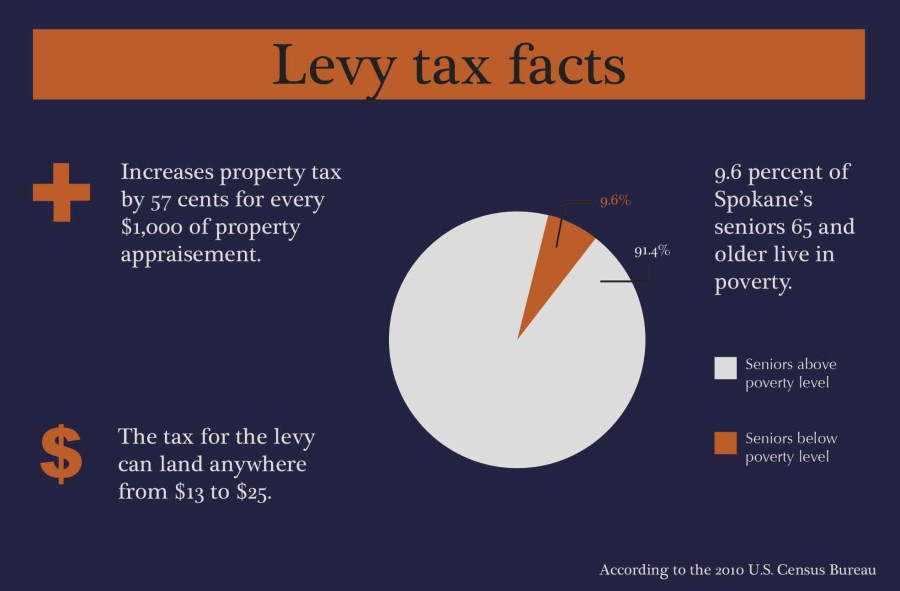

The street levy is a 20-year plan that increases the city’s regular property tax by 57 cents for every $1,000 of property appraisement, according to the levy resolution.

The city council believed low-income seniors and disabled individuals with a household income of $35,000 or less would be exempted from the tax, but the state and county said it was a levy lid lift instead of an excess levy, making the exemptions void, according to an article in The Spokesman-Review, entitled “Street levy surprises city, some residents with higher tax bills.”

The city then chose instead to enact an emergency budget ordinance C-35231, which authorizes a senior citizen local property tax exemption for levies following the Revised Code of Washington law 84.55.050.

The city council’s ordinance is for a local property tax that does not pursue any type of challenge to the state’s definitions of levy lift and excess levy, according to Laura McAloon, a partner in the Spokane and Seattle international law firm K and L Gates.

Jon Snyder, city council member of District 2, said utilities director Rick Romero brought the idea of the ordinance to council, which members voted unanimously to pass.

“We passed the ordinance giving a tax break to senior citizens and disabled veterans and the county refused to comply with it,” said Snyder.

The county requested advice from the Department of Revenue in regards to the new ordinance, which Spokane’s lawyers never saw, according to McAloon. They did receive a letter from the department making it appear like the county was asking if the city could extend a state tax exemption, which the city is not trying to do.

“We think there is some confusion on the part of the county for what the city did and the county’s role in implementing a local tax exemption,” said McAloon.

The exemption is for a local property tax and is only enabled on a local level, which does not expand into the state law.

Snyder said the department’s letter questioned the ordinance and the council’s ability to follow through with it.

“I have no idea why the county turned this down,” said Snyder. “The county is not 100 percent beholden to the Department of Revenue, and next year they can decided to turn it down again if we don’t get some kind of resolution out of this.”

According to Snyder, the city council modeled the ordinance after a state law on exemptions for seniors and disabled veterans.

“We thought we were on solid ground,” said Snyder. “In my mind, when a city passes an ordinance, that’s city law unless a court or judge, some higher authority, says that’s not the case.”

McAloon said this is an issue where only the courts can decide the outcome. So far, no court date has been decided.

“The county’s attorney just got on board the case within the last couple of days,” said McAloon. “We’re giving him some time to get up to speed.”

Tax bills without the exemption were already sent out by the county.

“That’s another thing that was kind of frustrating,” said Snyder. “They could have waited a little bit to start handing them out but they decided to go full speed ahead.”

According to the 2010 U.S. Census Bureau, 9.6 percent of Spokane’s seniors 65 and older live in poverty. The tax for the levy can land anywhere from $13 to $25.

“The tax can be small, as low as $25, but for a lot of these folks who are seniors on fixed income or are disabled veterans, they need every $25 they can get,” said Snyder.

![Simmons said the biggest reasons for her success this year were “God, hard work, and trusting [her] coach and what she has planned.”](https://theeasterner.org/wp-content/uploads/2024/05/image1-1-1200x800.jpg)