Counseling and Psychological Services reaches out to students

May 21, 2014

Pizza tastes better when it is free.

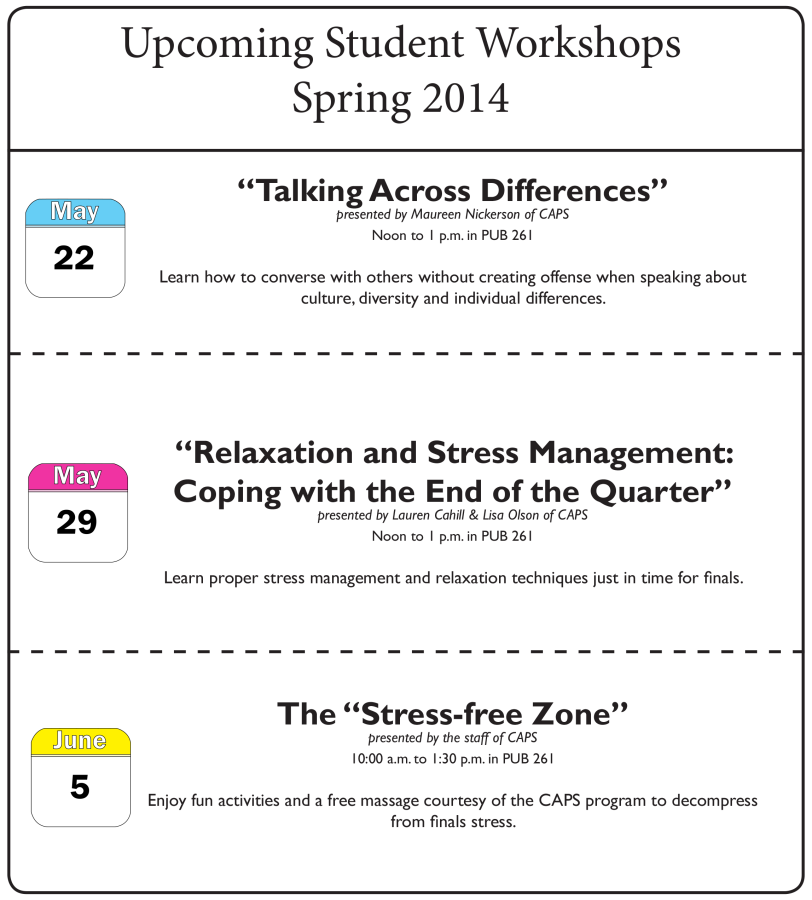

If the smell wafting from PUB room 261 does not attract hungry undergraduates to Eastern’s Counseling and Psychological Services’ Student Workshop Series, held each Thursday from noon to 1 p.m., the wide variety of topics being presented will.

Each quarter, CAPS sponsors the workshops, which tackle topics ranging from careers after college, to diversity issues, to health and wellness, to relationships.

Lisa Olson, coordinator of outreach services and psychological counselor at CAPS, organizes and manages the series.

“This is part of our outreach effort to connect with students,” Olson said. “We have different topics every week. Some of them are very much related to counseling and mental health, and things that a lot of students have concerns about or can cause a lot of stress in their lives.”

Melissa Frank, program coordinator for financial aid and scholarships, presented a workshop on May 15 about financial aid and loans for graduate school and how to plan for life after college.

“CAPS focuses on students’ well-being and mental health. Financial stuff, like financial aid and loans, is a part of that,” Frank said. “I think it’s great that CAPS offers the opportunity to look at topics you wouldn’t necessarily think surround mental health.”

Frank said as students approach the end of their undergraduate careers, they should be planning for their loan debts. Frank addressed repayment and consolidation of student loans, how to calculate interest, including daily interest rates and getting loans for graduate school.

EWU junior Aubrey Eliason said as a psychology major, she knows she will have to go to graduate school to become a clinical psychologist.

“I came to the CAPS presentation today because I’m looking at going to [graduate] school, and I’m not really sure how that works with financial aid,” Eliason said. “I’m on financial aid, and I am accruing loans, and I’m not really sure what the future looks like. So I was coming here to learn a little bit more.”

Eliason said she learned that the maximum amount of federal debt a student can have is $138,000.

“I just can’t help but see that number and know that’s probably going to be how much debt I have,” Eliason said. “I wanted to know specifically about scholarship opportunities for [graduate] school, and now I know, after coming here, that they aren’t as good as they are for [undergraduates]. [Undergraduate] students really have it good.”

Frank said it takes a lot of work to find scholarships, but for students willing to put in the time and research, there are a lot of scholarship opportunities available for both graduate and undergraduate students.

According to Frank, the goal of her presentation was to educate students about how loan debt impacts them as they go into their futures. She said that taking less loan money, even if it makes life a little rougher as a student, pays off later with less to repay.

“It’s really easy when you’re a student to not think about that, because you need that money while you’re going to school,” Frank said. “You need to get your tuition paid, your housing, your needs, and you’re thinking about school, which is what you should be doing.”

The CAPS Student Workshop Series is held every Thursday of each quarter except for the first week of classes and finals week. And yes, free pizza is provided to participating students.

First come, first serve.